Acquisition project | Compass Crew

CC App | B2B2C | OTA ( Stays and Experiences )

Understanding the Product

Define -

Unlike the previous generation, which traveled for sightseeing, the rising generation is more experience-oriented. They don't just want to visit a location but also want to immerse in the culture, taste the authentic food, experience the wild, hike, camp, and much more. (They also prefer it to be Instagramable )

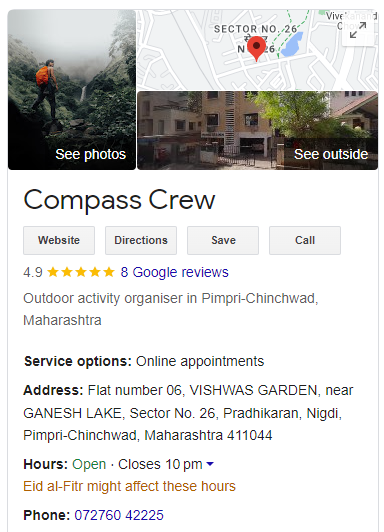

Yet, it is still difficult to explore authentic experiences, especially in locations that have heavy tourist influx. In niche categories like adventure experiences, there is still a lack of credibility and a lack of qualified adventure activity providers. And that's where Compass Crew (CC) comes into the picture.

Compass Crew is an aggregator platform for experiential stay hosts and experiential activity organizers. It is a one-stop solution for discovering, comparing and booking the stays and experiences around the desired locations. Unlike a traditional itinerary-selling travel business, CC's idea is to break travel into "experience blocks" and allow the user to select, mix and match the blocks to customize their own experience.

( The product is in the Pre-PMF stage and the model is very similar to Airbnb, hence a lot of data points of Airbnb are used as a proxy.)

Fundamental Assumptions -

1) There are many OTAs that provide the best options to book stay, transport and food options but none of them are focusing on selling experiences, which we believe is a huge market.

2) There is a huge unutilized potential in less explored locations, and with the help of technology, we can open a wide range of new options for travellers.

3) The adventure experiences market is very unorganized and CC can be a way of giving it a primary structure.

The problem statement -

Today, when the travel patterns of youth are shifting the course of the travel industry towards "experience oriented tourism", there is still a major chaos when it comes to discovering and booking authentic experiences.

In case of adventure tourism space, customers are unsure about the qualification and soft adventure space is over crowded with copy-paste experiences.

Elevator pitch

Imagine you and your friends are planning a trip to Pune. You have hear a lot about the treks, water-falls and camping activities around the city. So, the gang is excited.

First thing you do is, check sky scanner, compare flight tickets.

then go to MMT and check options for stay,

now you want to look for the options of treks and camping,

and you find yourself lost in the pile of poor quality websites and Instagram pages.

How would you take an informed decision?

That's where CC comes into the picture.

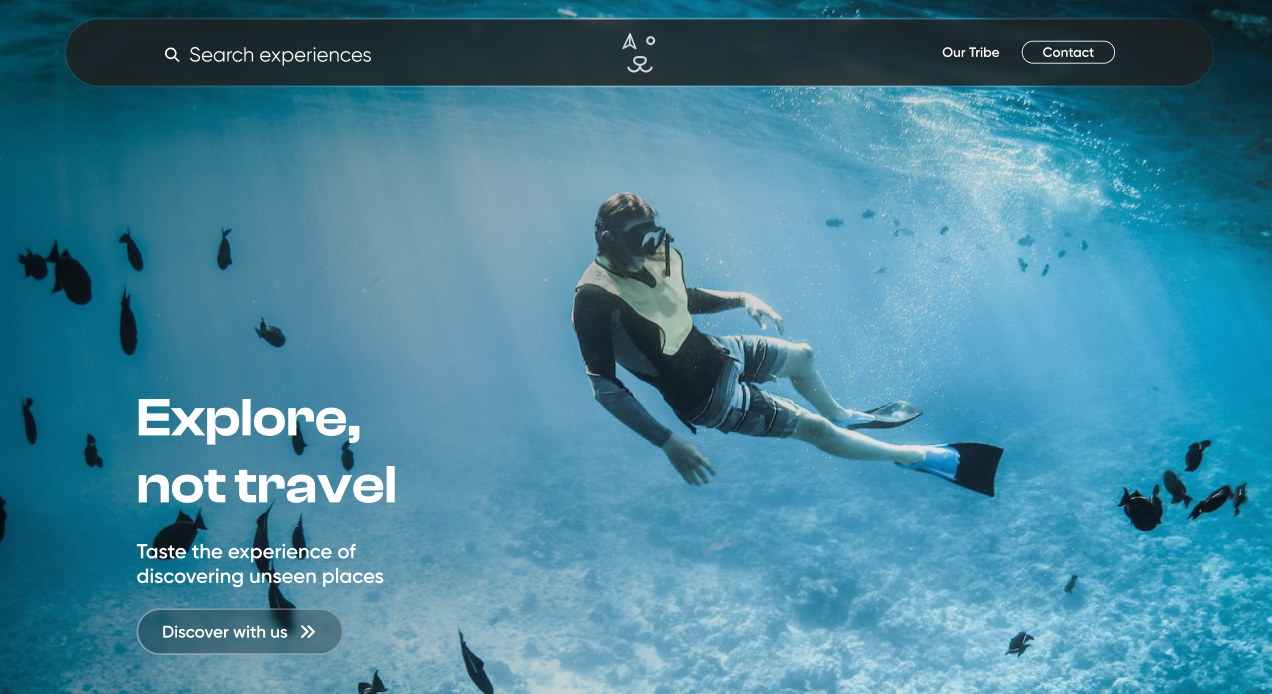

Imagine a website that not only helps you to discover unique stays but also gives you access to some of the most authentic experiences at the location you are planning to visit and customize you whole travel experience in few clicks?

Core Offerings and Features

(The Product is still in Pre-PMF stage.*)

The core value proposition for the user is

Discovery, Honest Information and ease of booking.

Hence the platform the designed to optimally cater to the user's core needs.

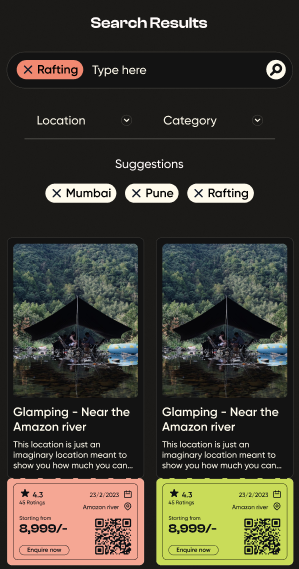

Listings categorization -

The listings are primarily categorised in 3 sections.

1) Staycations

2) Activities

3) Events

Where all the three categories are also tagged to each and every content piece present on the website.

Which makes our search very unique.

Search bar -

The purpose of the search bar is commonly known, but for a traveller can exploit it to find exactly what they need. Tagging every piece of listing and content enables user to gather as much information as they want, before taking the decision.

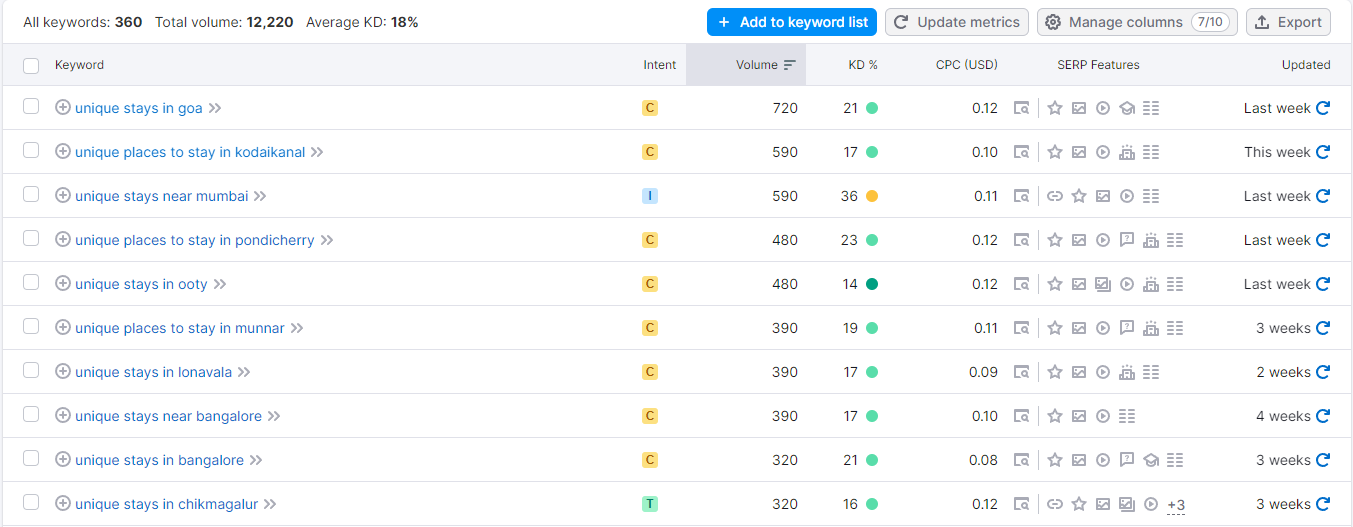

Quality of content and personalization -

At CC we believe in the power of quality content and we try to exploit user's Aesthetic-usability bias.

Thats why most of the content is created by our own in-house team. It helps us to stand out from the noise.

( Dive deep in the content loop section )

Competitors

Parameter | Airbnb | MakeMyTrip | Booking.com |

Trust Factor (India) | Mid | High | Mid |

Business Model | Aggregator that connects hosts to guests. | Online travel agency bookings of Hotels, flights, etc. | Online travel agency bookings of Hotels, flights, etc. |

Types of Listings | Diverse range including apartments, houses, unique stays, and experiences | Primarily hotels, resorts, guesthouses, and vacation rentals | Wide variety including hotels, apartments, villas, and hostels |

Prices | Can range from budget to luxury, often influenced by location and amenities | Competitive pricing, occasional discounts, and deals on various accommodations | Offers a range of prices, often with options for budget to upscale stays |

Cons | Limited guarantees compared to traditional hotels, occasional issues with hosts or properties | Occasional discrepancies between listed amenities and actual offerings, less control over the property experience | Occasional discrepancies between listed amenities and actual offerings, less control over the property experienc |

Understanding the User

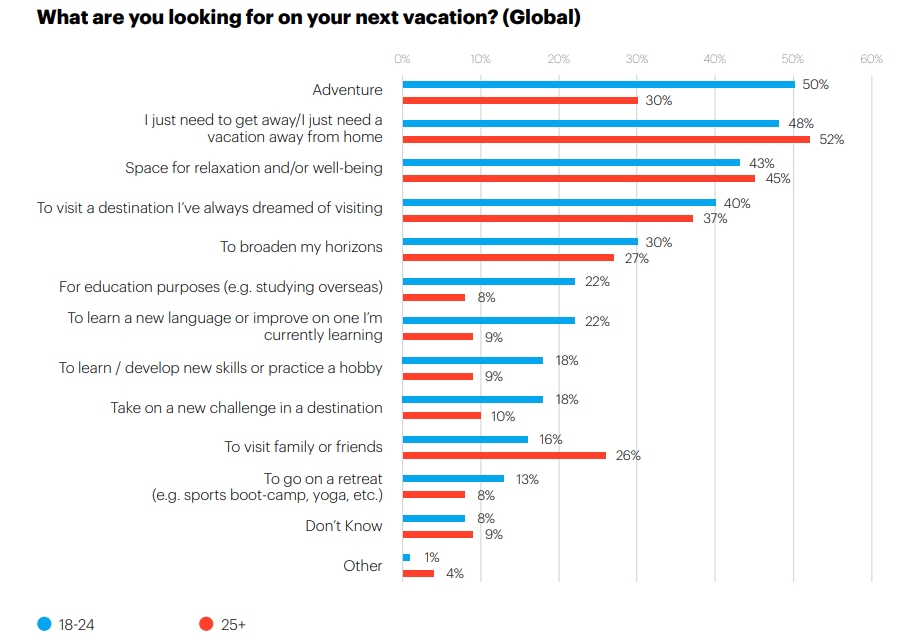

Data shows that since October 2020 propensity to travel in the next 12 months is at its highest among the younger generation of 18-24 years old. This cohort, (we refer to as Gen Z in this paper), is made of young people who will make the big transition between student life and financial independence in the next few years.

Even though the Gen-Z is inspiring the new age of travel, the spending capacity of gen-z is still limited.

Hence we can not ignore the comparatively mature and frequent travelers like Biz travelers and Family vacations.

| ICPs (Indian context) | Saloni | Sourabh | Pratik |

Persona | Experience-Oriented Traveler | Biz Traveler | DIY Traveler |

Age | 28 | 48 | 22 |

Occupation | Marketing Manager | Tech CEO | Freelance Designer |

Annual Income | 12-18 LPA | Above 40 LPA | 6-10 LPA |

Location | Pune | Bengaluru | Varanasi / Hrishikesh / Hampi (Digital Nomad) |

Psychology | Passionate about food and culture willing to talk and engage in activities with other people willing to take risks or to try out new ideas or experiences | Time-conscious Focused on productivity Value comfort and reliability Willing to pay extra for it | Budget-conscious Loves to plan and customise expect personalised experiences Seeks value for money |

Pain points | Overcrowded destinations Generic touristy experiences Hard to find authentic experiences | Locations of the stays from work place Stay's work-friendlyness Tired of constant travel and traditional hotel experiences | Expensive accommodations Location of the stay and access to local transport. difficulty in finding unique stays and amenities like kitchen and washing machines. |

Where do they spend their free time? | Cafes, Malls, Social Media | Flights, Cafes, Social Media | Exploring New Locations, Social Media |

Other Apps | Cred, BookMyShow, Instagram, Youtube, Skyscanner, Zomato/Swiggy, Airbnb | LinkedIn, Skyscanner, Moneycontrol, Zomato/swiggy, Bookmyshow, Makemytrip, ixigo,Airbnb | Instagram, Youtube, ixigo, Zostel, Tripadvisor, Quora. Airbnb |

If CC fails them then where would they go next? | Airbnb | MakeMyTrip (Traditional Hotels) | Zostel, The Hosteller, GoStops |

Duration between discovery and action | Avg 1-1.5 Month | 1-7 days | Unpredictable / Random |

Avg Duration of stay? | 3-6 Nights | 1-2 Nights | 10-30 Nights |

How do they research for travel. | Web / Social Media | Web | Digital + communities |

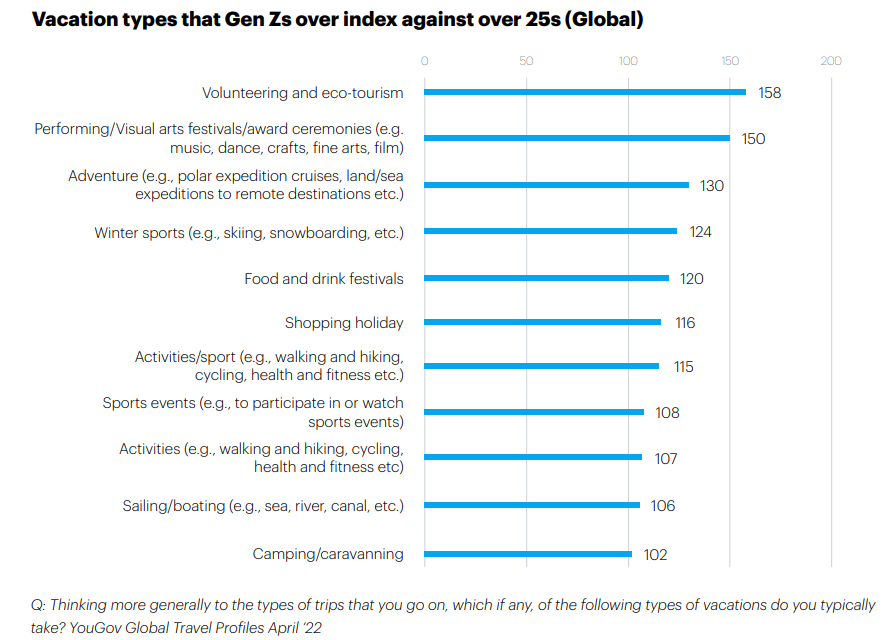

Sneak peak into what Gen Z wants from travel -

ICP prioritization -

As CC is in pre-pmf stage, all experimentation and content creation is based around building a travel brand that caters primarily to the Gen-z/young traveller.

Hence "Saloni" becomes our Priority 1 out of the three ICPs.

Followed by "Saloni", "Sourabh" and "Pratik" will be prioritized as P2 considering their spending capacity and frequency of travel respectively.

ICPs | Priority | Frequency of travel | Spending capacity | Spends of experiences |

| Saloni | P1 | Mid | High | High |

| Sourabh | P2 | Mid | High | Low |

| Pratik | P2 | High | Low | Mid |

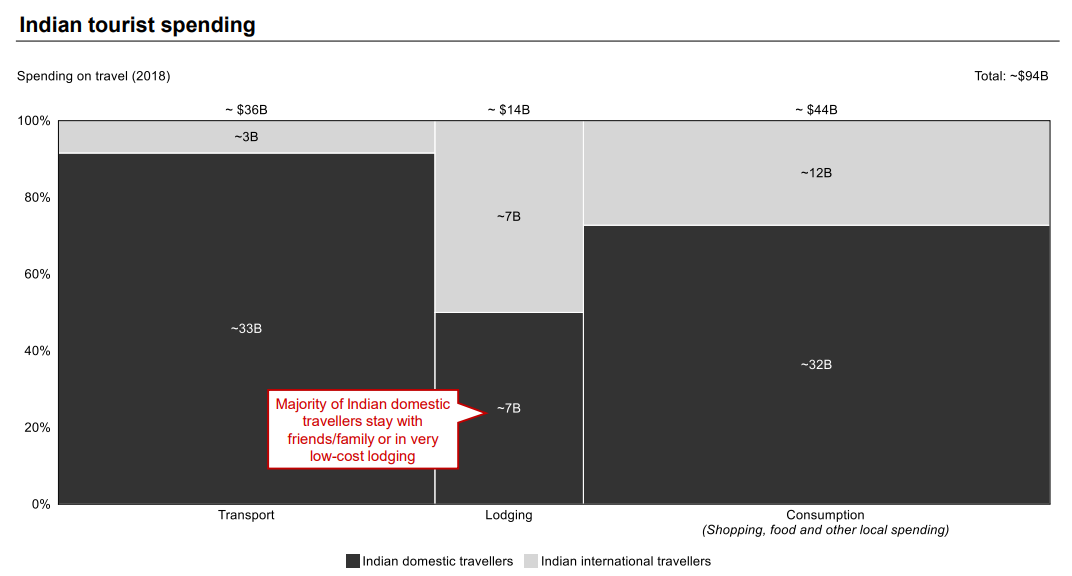

Understanding the market

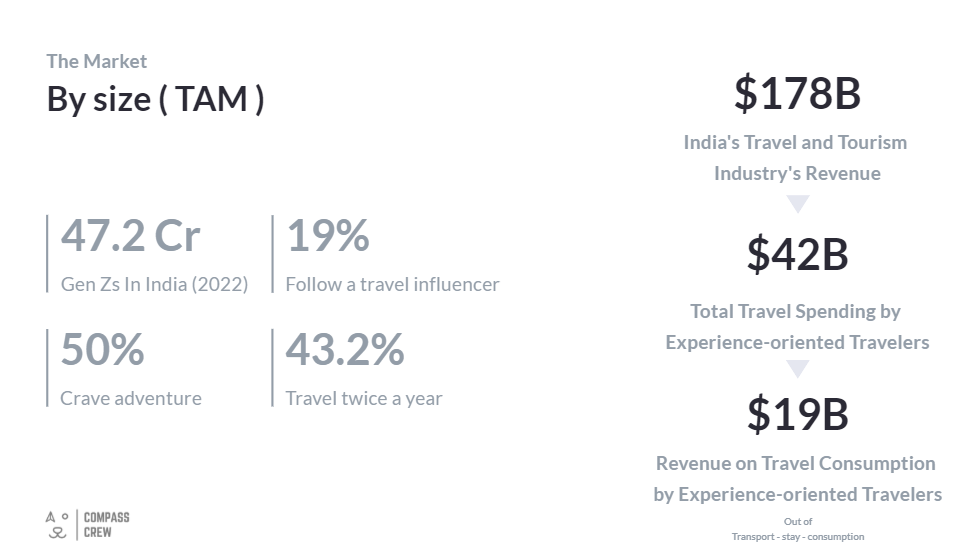

Experience-oriented traveller ($22 billion): About 70% book online. They research extensively online and offline for “authentic” experiences and convenience of options. They display high loyalty to their preferred airline and hotel brands and actively shares experiences.

What does Instagram Indicate about the market -

- Shift from static photos to stories and reels: Travelers are increasingly sharing immersive content showcasing experiences rather than just posed pictures. This format allows them to capture the essence of the journey, highlighting activities and local interactions.

- Rise of travel influencers: Travel influencers on Instagram promote experience-oriented travel through their content. They focus on showcasing unique activities, hidden gems, and local culture, inspiring others to seek similar experiences.

TAM ( top to down approach)

Justification: This represents the total market size of the experience oriented travelers in India.

Note: Transport is not considered as it is not concerned with CC, this data is purely around the consumption of stays and experiences.

SAM -

- Proxy 1: Internet & Smartphone Penetration

- Proxy 2: Growth of Online Travel Booking in India

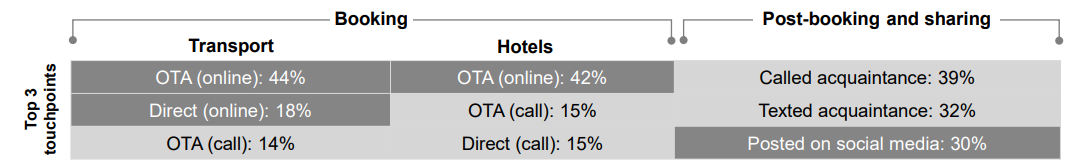

Prioritizes convenience (71%) or preference for modes of transport (58%) to ensure pleasant travel experience; high loyalty towards preferred online booking providers (66%)

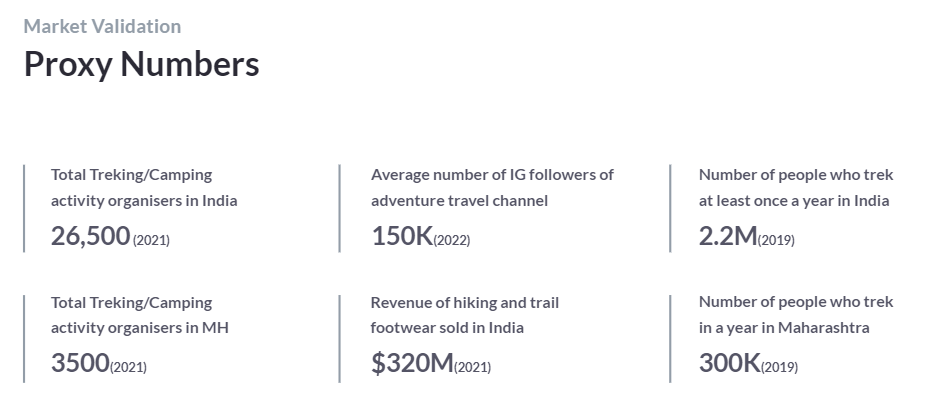

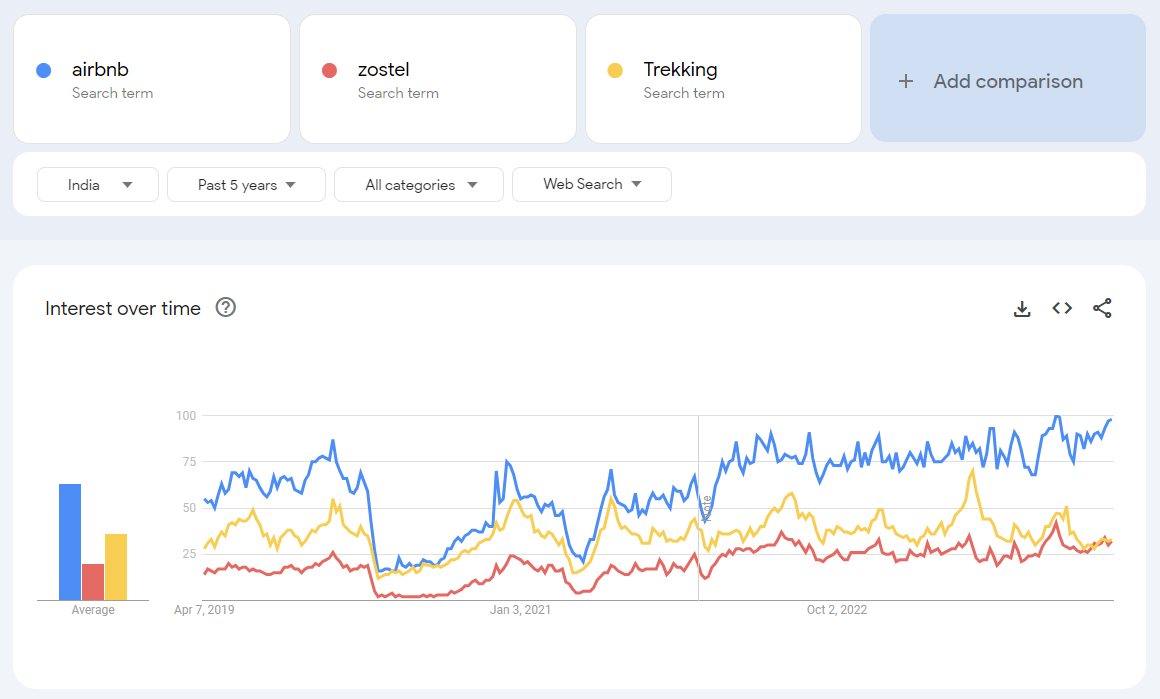

Market Validation -

Acquisition Strategies

Channel Selection Framework -

Channel | Effort | Cost | Flexibility | Lead time | Scale |

Organic | Medium | Low | Low | High | Medium |

Paid Ads | Medium | High | High | Low | High |

Referral | Medium | Medium | High | Low | High |

Product Integration | High | Medium | Low | Low | Low |

Content loops/Influencer Marketing | Low | Low | High | Low | High |

Selected Channels - Organic | Content Loops

Content Loops -

We observed that there is a common set between the sets of Instagram audience, Exp oriented travellers and the Gen - Z and this combination makes travel more and more interesting.

Content plays a major role in inspiring tourism and one of the primary channels for travel related content would be -

- Youtube

Case 1 -

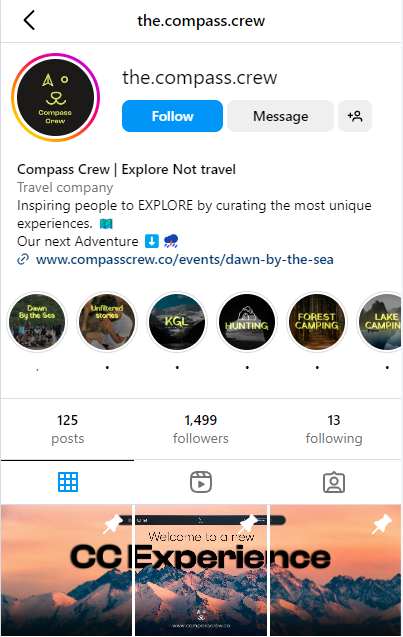

Growing Instagram Presence

Post covid there has been a significant increase in vertical format content creation and consumption. One of the common categories of content on IG is Travel content. While there is already a heavy demand for such content, it is a golden opportunity for brands like CC to become a source for authentic and high quality content source.

We have already experimented on this for last one year and results were Satisfying.

We conducted over 20 events.

Avg participation was 15 seats per event.

Avg Ticket size was 2900 INR

and we managed to sell all of these seats using only organic content on Instagra.

How it loops -

Step 1 - Hook

CC creates high quality content around one destination and builds hype.

Step 2 - Opportunity

We offer an opportunity to experience it with CC.

Step 3 - Experience

We take people to the places and deliver what was promised

Step 4 - Shout outs

The happy customers post content on IG and share their experience with their friends.

Back to Step 1 -

For the next event we again create high quality content based on the last event and start building the hype.

This way, people who were present in last event get a chance to be featured on the page and it creates a personalized experience for them.

Challenges - Event coverage / experience coverage for every activity is costly and operations heavy.

Content creator - Customers

Distributor - Instagram

Channel - Organic (SM)

Case 2 -

Paid Content promotions

Compared to paid search, IG paid micro - campaigns can give great results when performed correctly.

Key points that worked for us -

- Purposeful content - Targeting the audience and narrowing down on a specific value proposition for one micro-campaign.

- Specified KPIs - Keeping track of the campaign daily and testing its performance. ( stopping the once that are leaking money. )

Organic

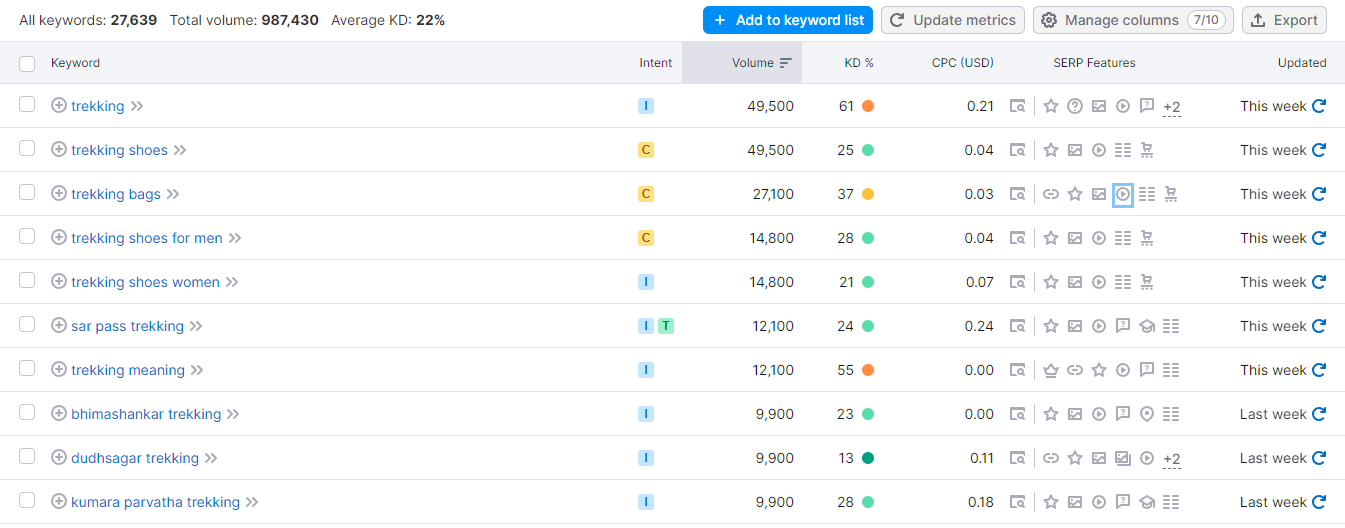

Solving for the search intent -

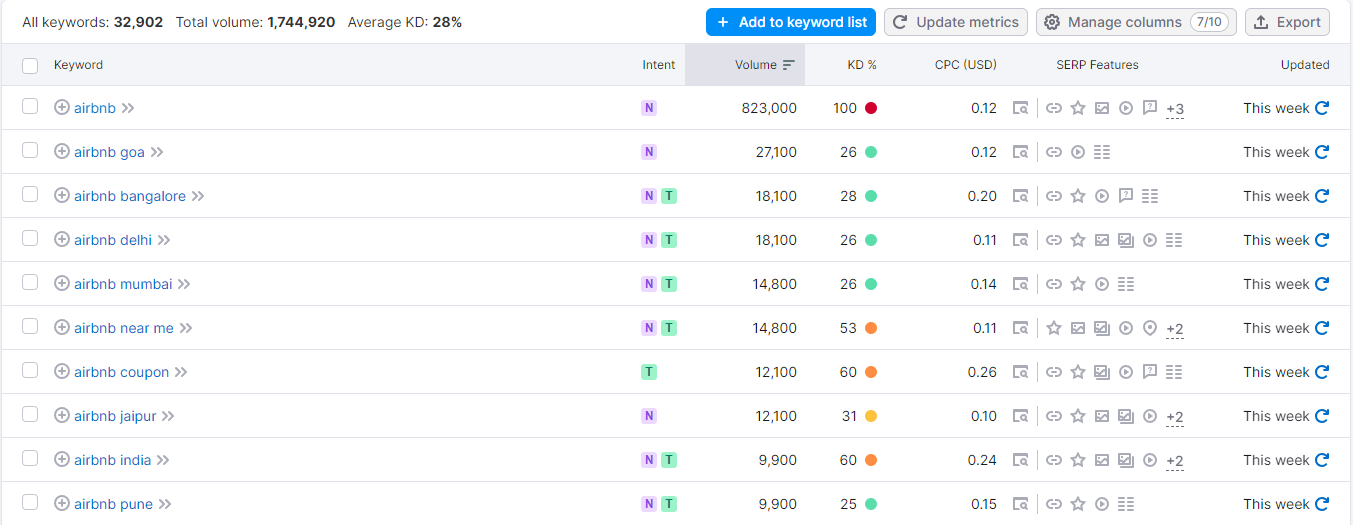

Keywords -

key phrase | search volume | effort to rank | time to get an out come | search to click rate | Conversion Rate | |

| Use case | Treking near me | 37,000 | High | Low | High | Med |

Unique stays near me | 11,000 | Loq | High | High | Med | |

Home-stays near me | 3,000 | Low | Med | Low | High | |

| Brand Name | Compass Crew stays | - | Low | High | Low | Low |

Compass Crew Treks | - | Low | High | Low | Low | |

Compass Crew activities | - | Low | High | Low | Low | |

| Use case topic | Things to do in Lonavala | 45,000 | High | Med | High | Med |

Activites in Manali | 87,000 | High | Low | High | Med | |

Backpaker hostel near me | 11,000 | Low | High | Low | Low | |

| Your Competitor | Airbnb near me | 20,000 | High | High | Low | High |

Zostel near me | 6,700 | High | Med | Low | High | |

Stay Vista properties near me | 3,200 | High | Med | Low | Low |

SEO -

Content Optimization:

- Landing pages: Create dedicated landing pages for different types of stays (beach houses, apartments, etc.) and experiences.

- Blog content: Develop informative blog posts targeting travel interests and destinations.

- Examples: "Top 10 Unique Stays in India," "Budget Travel Guide to [City]," "Benefits of Vacation Rentals for Families"

- City and region pages: Optimize city and region pages with relevant keywords and information about available rentals and experiences.

- High-quality visuals: Use attractive photos and videos showcasing unique properties and experiences offered by CC.

Technical SEO:

- On-page optimization: Optimize website elements like title tags, meta descriptions, and header tags with relevant keywords.

- Mobile-friendliness: Ensure the website offers a seamless user experience on mobile devices, where most travel searches happen.

- Website speed: Optimize website loading speed for better user experience and improved search ranking.

- Structured data: Implement schema markup to provide search engines with richer information about properties and experiences.

Link Building:

- Partnerships: Collaborate with travel bloggers and influencers for backlinks and promotion.

- Guest blogging: Contribute guest posts to travel websites with relevant backlinks to Airbnb.

- Local listings: Ensure Airbnb listings are present on local directories and tourism websites.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.